As a self-directed investor, understanding the forward-looking nature of stock prices is crucial to making informed investment decisions. In this guide, you’ll discover the secrets behind stock prices and how factors such as future earnings, growth prospects, market sentiment, risk and reward, and the business cycle all play a role in determining stock prices. By understanding these factors, you’ll have a better understanding of why stocks are priced the way they are. So, let’s dive in and unlock the secrets behind stock prices.

Future Earnings And Stock Prices: Link to The Past

Future earnings are critical in stock valuation because they provide a glimpse into a company’s future capital. For purposes of this discussion, capital reflects the excess of assets over liabilities. Since long-term investors are essentially business owners, they are most interested in a business’s assets. These assets take many forms: cash, property plant and equipment (PPE), research and development (R&D), to name a few. Each asset plays a unique role for the business: cash is the most liquid and can be used for investing in the business or for dividends, PPE is more functional and is used by the business to help create goods/services, and R&D fuels future growth. These qualities make assets important in pricing stocks and provides a direct link to stock prices. If a business can generate strong future earnings, then it will have more assets in the future–cash for dividends or to invest in PPE or R&D. Long-term investors will value this future ability today. Long-term investors are willing to pay up for businesses with more future earnings potential than businesses with lower potential. This helps explain why some stocks are seemingly overvalued when in reality they could just be accounting for greater future earnings potential. Consequently, stocks will always be priced higher than if the price was based solely on current earnings. Keep in mind it is difficult to accurately forecast future earnings. This explains why stock prices can diverge from what appears to be the consensus.

Consider the real-world company, Microsoft Corporation. At the end of 2017, based on common valuation metrics, Microsoft was seemingly overpriced: P/E 45.69, EPS $1.75, and stock price $79.96. This means investors were willing to pay 45X earnings, which is about 45 years’ worth of earnings at that time (from 2014-2023 Microsoft’s average P/E = 29). However, long-term investors who projected strong future earnings (in terms of EPS) and paid the seemingly high price would have been richly rewarded. At the end of 2022, Microsoft had: P/E 33.97, EPS $11.05, and stock price $375.35. That would have returned an investor 369.31%. Therefore, the high stock price of Microsoft at the end of 2017 could have been justified as it reflected the investors’ confidence in the company’s future cash flow potential ($1.75 – $11.05), even if it seemed overvalued when compared to the earnings at that time.

Pricing in Growth: The Gordon Growth Model

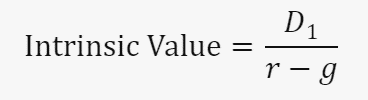

Another factor that influences stock prices is the future growth prospects of a company. Growth prospects are the opportunities and challenges a company faces in expanding its market share, customer base, product range, or geographic reach, to name a few. Investors are attracted to companies that have strong growth prospects because they imply increased or at least maintained profitability. The higher the growth prospects of a company, the higher its stock price will be, and vice versa. A good way of seeing the relationship between growth and stock prices is through the simplified Gordon Growth Model (GGM). The GGM is a valuation model used to determine the intrinsic value of a stock based on a future series of dividends that grow at a constant rate. Note, that this model makes major assumptions not applicable for all stocks. The model calculates the intrinsic value of a stock as:

where:

D1: is the value of next year’s dividends,

R: is the constant cost of equity capital for the company (or rate of return),

G: is the constant growth rate expected for dividends, in perpetuity.

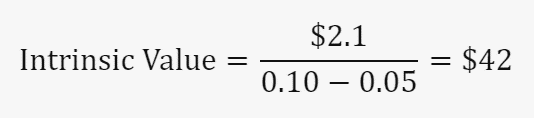

Let’s consider the hypothetical company, GrowthCo, with a required rate of return (r) of 10%.

Scenario 1: High Growth. If GrowthCo’s dividends are expected to grow (g) at a rate of 5% per year, the dividend next year (D1) would be $2 * 1.05 = $2.1. The intrinsic value of the stock would be:

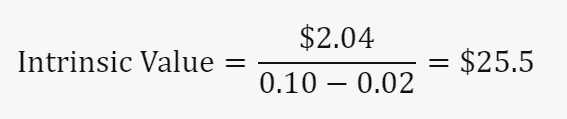

Scenario 2: Low Growth. If GrowthCo’s dividends are expected to grow (g) at a lower rate of 2% per year, the dividend next year (D1) would be $2 * 1.02 = $2.04. The intrinsic value of the stock would be:

As you can see, there is a significant change in price for a 3% change in growth rates. This also highlights how sensitive the GGM is to growth rate assumptions. Regardless, the GGM is a great way to see the direct link between growth rates and stock prices. This explains why sometimes high-growth low-income companies are richly priced because they have high growth rate assumptions. Furthermore, this relationship helps explain why some high-growth companies have such rich valuations because they often have high growth expectations.

Market Sentiment: Herd Mentality

A third factor that affects stock prices is the market expectations of a company. Market expectations are the collective opinions and sentiments of investors, analysts, media, and other stakeholders about a company’s performance, prospects, and value. Market expectations are influenced by various factors, such as news, rumors, reports, events, trends, and emotions. Market expectations can create a gap between the actual and perceived value of a company, which can cause its stock price to fluctuate. The higher the market expectations of a company, the higher its stock price will be, and vice versa. For example, if a company receives positive media coverage that boosts its reputation and brand, its stock price will likely rise as investors increase their awareness, confidence, or demand. On the other hand, if a company is involved in a scandal or a lawsuit that damages its image and credibility, its stock price will likely fall as investors lose their trust and sell their shares.

An example of how market expectations can impact stock prices is reflected in the artificial intelligence (AI) hype that began in 2022. NVIDIA, a leading player in the AI and graphics processing unit (GPU) market, serves as a real-world example of how market expectations/sentiment can significantly impact stock prices. A significant catalyst for the AI hype was the launch of ChatGPT on Nov 30, 2022. This had a significant impact on sentiment and expectations that this new form of AI would be revolutionary. Since NVIDIA is a leader in chip processors used in AI, its stock price was significantly impacted by the sentiment. NVIDIA’s stock price went from about $110 in the lows of Oct 2022 to over $700 by the start of 2024—a 536% increase. Granted, NVIDIA experienced substantial revenue growth to help justify its sharp price increase. It was still trading at a relatively extreme P/E multiple of 100. Although the company was delivering strong financials, people were still willing to pay an unusually high price for the stock, which could arguably be rationally explained as being caused by the market sentiment at that time. This underscores how a company’s stock price is not just a reflection of fundamental valuation but also based on market sentiment.

Risk And Reward: Risk it For The Biscuit

A fourth factor that impacts stock prices is the risk and reward of a company. Risk and reward are the trade-offs that investors face when choosing between different investments. Risk is the uncertainty and variability of the returns of an investment, while reward is the potential gain or loss of an investment. Investors are generally risk-averse, meaning they prefer investments that have lower risk and higher reward. The lower the risk and higher the reward of a company, the higher its stock price will be, and vice versa. For example, if a company has a stable and predictable business model that generates consistent earnings and dividends, its stock price will likely justify a high price because investors value its reliability (reward) and safety (low risk). On the other hand, if a company has a volatile and unpredictable business model that depends on uncertain factors, such as innovation, regulation, or consumer preferences, its stock price will likely be low as investors discount its riskiness and uncertainty.

A good example of the risk/reward trade-off was the race for COVID-19 vaccines. There was an immediate need for a vaccine to curb the spread of the COVID-19 virus. The reward for being the first to mass produce the vaccine was clear, but the risk was entering the expensive race without being one of the first to finish. Pfizer, a pharmaceutical giant, embarked on this high-risk venture to develop a COVID-19 vaccine in collaboration with BioNTech. The process was filled with uncertainties, including the scientific challenge of developing a successful vaccine, the regulatory hurdles of gaining approval, the operational task of manufacturing and distributing the vaccine globally, and not to mention all of this in an unprecedented short period. However, the potential reward was substantial. Pfizer was one of the first to receive approval and mass-produce a vaccine. This led to an increase in stock price from roughly $32 at the beginning of 2020 (before COVID), to approximately $54 at the end of 2021 (69% increase). More specifically, on Nov 9, 2020, when Pfizer announced its vaccine succeeded in final-stage clinical trials the stock price jumped 15% closing at $37.19. Some may have thought that after a jump of 15% on that news there was not much upside left in the price. But looking back, the stock still had some room to run ($37.19 – $54). This highlights that companies that on risks and succeed are rewarded with higher stock prices.

The Business Cycle: The Rise And Fall of Earnings

A fifth factor influencing stock prices is the anticipation of stages in the business cycle. The business cycle consists of 4 stages: recovery/trough, expansion, peak, and contraction. Each stage of the business cycle significantly influences a company’s earnings. During the recovery/trough phase, the economy is recovering from recession, leading to a flat/slight increase in GDP, and business/consumer activity. In the expansion phase, the economy is quickly growing with rapid GDP growth, and business/consumer activity. The peak phase represents the height of economic activity, but with economic activity peaking or rolling over. GDP, business/consumer activity moderating/declining. At the peak, inflationary pressures often lead to interest rate hikes, which can oftentimes lead to a recession or contraction. During the contraction phase, economic activity declines leading to a reduction in GDP, and business/consumer activity. However, the contraction is often ended when interest rates are reduced causing an increase in economic activity restarting the business cycle. Investors closely monitor these stages to make informed decisions about their investments. Generally speaking, stock prices often reflect the current/upcoming stages of this cycle through corporate profitability. When profitability is strong, prices tend to be relatively higher than when profitability is weaker. All else being equal, you would expect higher prices at the peak relative to the trough. Therefore, by understanding the current/future stages business cycle, investors can better understand stock prices.

Consider a hypothetical mining company, MineralMasters Inc., which is closely tied to the business cycle. During the recovery/trough phase, the economy begins to rebound from a downturn, leading to a modest increase in demand for minerals. This uptick results in a slight improvement in MineralMasters Inc.’s earnings. The stock market, recognizing the early signs of recovery, may start to reflect a cautious increase in MineralMasters Inc.’s stock price. As the economy progresses into the expansion phase, economic growth accelerates, and the construction and manufacturing sectors boom, significantly boosting the demand for minerals. MineralMasters Inc. capitalizes on this increased demand, which translates into higher profits and, consequently, a rise in its stock price as investors respond to the company’s enhanced profitability. When the economy reaches the peak stage, MineralMasters Inc. experiences the zenith of economic activity. However, with economic indicators showing signs of peaking and potential interest rate hikes on the horizon, demand for minerals may begin to level off. This change can lead to a stabilization or even a slowdown in MineralMasters Inc.’s earnings growth, and its stock price may reflect this anticipated plateau. In the contraction phase, economic activity diminishes, and sectors like construction and manufacturing scale back, leading to a decrease in demand for minerals. MineralMasters Inc. faces a downturn in profits, and the stock market, foreseeing reduced future earnings, may lower the company’s stock price. This example illustrates, all else equal, how the stages of the business cycle can impact stock prices.

Conclusion

In conclusion, stock prices reflect the future and are influenced by a variety of factors, including future earnings, growth prospects, market expectations, risk and reward, and the business cycle. By understanding these factors, investors can better anticipate future stock prices and make informed investment decisions. The stock market is forward-looking, and stock prices often reflect market pricing. Therefore, understanding what the market prices in for stocks is important for making informed investment decisions.

RELATED POSTS

View all