Interest Rates: The Driving Force Behind Investment Decisions

February 1, 2024 | by lonewealth.com

Like the heartbeat of the economy, interest rates pulse through the veins of financial markets, dictating the rhythm for making smart investment decisions. Understanding the meaning, math, and the cause-and-effect relationship affecting interest rates is crucial for making smart investment decisions. For the self-directed investor, these rates are more than just numbers—they are the blueprints for building an investment portfolio. In this blog post, we’ll explore the anatomy of interest rates and their profound impact on your investment strategy and financial health.

Overview of Interest Rates

Interest rates are the cost of borrowing money, typically expressed as a percentage of the value of the loan. Over time, rates have evolved to be a critical part of investing and portfolio management. Self-directed investors need to understand that their money will grow over time based on multiple factors, but the most critical is the interest rate. Interest rates also known as rates of return, and discount rates reflect a similar concept; They describe a relationship between cash flows and time. The Rate of return is a forward-looking concept that expresses what money today will earn into the future, and the discount rate refers to what future money is worth today. Additionally, interest rates can also reflect an opportunity cost; the return given up when choosing one investment over another. The S&P 500 averages roughly 10% per year, but if you decide to invest in a 4.5% government bond, then you are foregoing the opportunity to earn an extra 6.5%. This is why interest rates are so important for self-directed investors because they are important to understanding what return you can earn over time, and you can also think about your future cash flows as a value today.

Interest Rates: It’s All in The Numbers

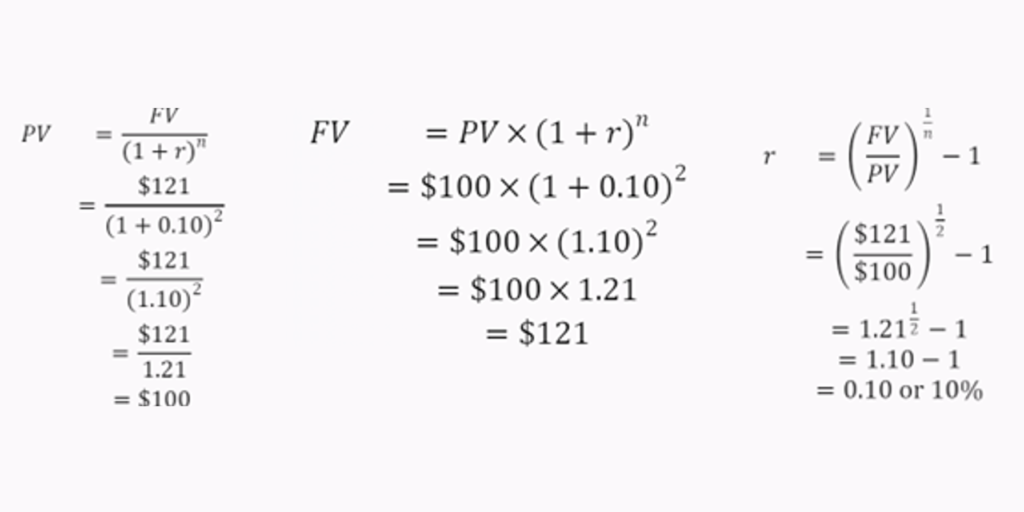

Understanding how interest rates flow through time is more of an abstract discussion until math paints the picture. The key takeaway from the math is the integral relationship between price, rates, and time. For example, see below an example of calculating a future price, present price, and the rate of a $100 bond today that expires in 2 years with a rate of 10%.

Where:

- (FV) is the future value of the cash flow.

- (PV) is the present value or initial amount of the cash flow.

- (r) is the interest rate per period.

- (n) is the number of periods.

Let’s consider a practical example: suppose you have $10,000 to invest and you’re faced with two options – a government bond yielding 4.5% or an equity investment with a potential return of 10%. If you choose the government bond, your investment will grow to approximately $11,500 after two years (using the formula (FV = PV*(1+r)^n)). On the other hand, if you choose the equity investment and it does yield a 10% return, your investment will grow to approximately $12,100 after two years. This simple comparison underscores not only how the interest and time affect the price of an investment, but also the opportunity cost of choosing one over the other. Note, that if have any three of the four inputs, you can solve for the other.

The math also unveils a critical relationship between price today and interest rates—they are inversely related. When it comes to investing it is important to know that if interest rates are rising, then by the math above, the price is dropping. For instance, bonds express this relationship, if central banks raise rates, then the price of bonds in your portfolio will decline—this also means that the regular payment (coupon) will increase.

Central Banks: The Interest Rate Puppeteer

Central banks are the puppeteers pulling the strings of interest rates. Central banks conduct monetary policy to regulate the economy and price stability (low and stable inflation). Inflation leads to a general increase in prices over time, reducing the purchasing power of money. Central bank’s main tool for controlling price stability is the short-term bank lending rate. They set the minimum rate that a retail bank can borrow funds directly from them, which in turn controls the rate that banks lend to consumers. This base rate reverberates throughout the economy, ultimately affecting inflation. The central bank can slow an overheated economy with high inflation by raising interest rates, thereby, making it more expensive to borrow and discouraging economic activity. The reverse is also true, central banks can raise inflation by lowering rates, thereby, encouraging borrowing and economic activity. This is why mortgage rates saw a dramatic repricing coming out of the COVID-19 pandemic. Post-pandemic, as inflation ran hot central banks around the world were forced to raise rates to cool inflation. However, by raising the rates, this also caused a spike in mortgage rates. This also affects bonds across durations, most notably substantially increasing short-term yields. Because central bank interest rate decisions are so impactful, they offer forward guidance. In the US, the Federal Reserve releases regular Summary of Economic Projections, which projects out an appropriate policy interest rate.

Interest Rates: Your Guide to Smart Investing

Interest rates may not affect your investment decisions on a micro level day-to-day, but it is important on a macro level to understand the current interest rate regime. When interest rates are low, investors may be inclined to invest in riskier assets like equities, which could potentially offer higher returns. Suppose the central bank has set interest rates at a low level, say 1%. In this environment, a safe investment like a government bond might yield around 1%. However, an investor looking for higher returns might walk up the risk spectrum to achieve a higher return. Let’s say they invest in a tech startup’s equity. The startup does well, and the investor’s equity grows by 15% in a year. In this case, despite low interest rates, the investor was able to achieve a higher return through equities. Now, imagine the central bank has raised interest rates to 5%. Government bonds now yield around 5%, which is quite attractive compared to the potential returns from the stock market—on a reward/risk basis. The same investor now decides to buy these government bonds instead of investing in the risky tech startup. Even though the return is lower than the potential 15% from the startup, the investor is guaranteed a 5% return with the government bonds. If the startup fails, the investor will be glad to have made the safe choice.

There is an important note about understanding fixed-income (bonds) returns based on interest rates. There are 2 types of returns: 1) Cash payments like coupons or dividends, or 2) Capital gains from price appreciation. When interest rates are high you may be excited because cash payments from bonds will be higher, however, if you already own the bonds, then you will show an unrealized loss because the price will decline. For example, suppose current bonds yield 3% priced at par ($100), meaning they will payout $3/yr. If rates rise to 5% then newly issued bonds will yield $50/yr. However, the old 3% yielding bonds are less attractive, so the price will decline to reflect this and anyone holding those bonds will see an unrealized loss on the price of their bonds. The reverse of this is also true, revealing an important inverse relationship between the price of a bond and interest rates: an increase in interest rates lowers bond prices, and a decrease in interest rates raises bond prices.

This has important implications when investors project out and manage their investment portfolio. Take a generic 60/40 portfolio (60% stock/40% bonds). If your portfolio is fully invested and rates rise, then generally your portfolio should take a hit because of the rate/asset price inverse relationship (banks could be an exception). The opposite is also true, your fully invested portfolio would gain from interest rate declines. However, in each environment, the opportunities may be different due to the cyclical nature of the business cycle. A low-rate environment is not attractive for bonds since they offer low yields at high prices and would see capital losses during a rate hiking cycle. Conversely, bonds are attractive in high-rate environments because they offer high yields at low prices and would see capital gains during a rate-cutting cycle.

Conclusion

Interest rates are the heartbeat of the economy, pulsing through the veins of financial markets and dictating the rhythm for making smart investment decisions. As a self-directed investor, understanding the meaning, math, and cause-and-effect relationship impacting interest rates is crucial for building a strong investment portfolio. Don’t let the numbers intimidate you – with knowledge and insight, you can harness the power of interest rates to make informed choices and achieve financial success. So, take control of your financial destiny and let interest rates be your guide to smart investing.

RELATED POSTS

View all